The situation in France

A decree dated March 15, 2020, published in the JO on Monday March 16, provides important clarifications on the impact of measures to combat the spread of the Covid-19 virus on automotive service companies.

The following establishments are authorized to receive the public:

- Maintenance and repair of motor vehicles ;

- Sale and repair of motorcycles and cycles ;

- Automotive equipment trade.

- Retail sale of fuels in specialized stores (service stations) ;

- Parking lots.

Tow truck operators fall under APE codes 45-20 A and 45-20 B: maintenance and repair of motor vehicles.

The repair of industrial vehicles is not expressly listed as an authorized activity. However, the Highway Code does not define a motor vehicle, and this activity comes under APE Code 45-20 B: maintenance and repair of other motor vehicles.

Motor vehicle rental is not expressly listed among the authorized activities. However, the decree authorizes the reception of the public in equipment and goods rental establishments, without further specification.

Vehicle sales activities (except motorcycles and cycles) are closed to the public, except for delivery and order collection activities.

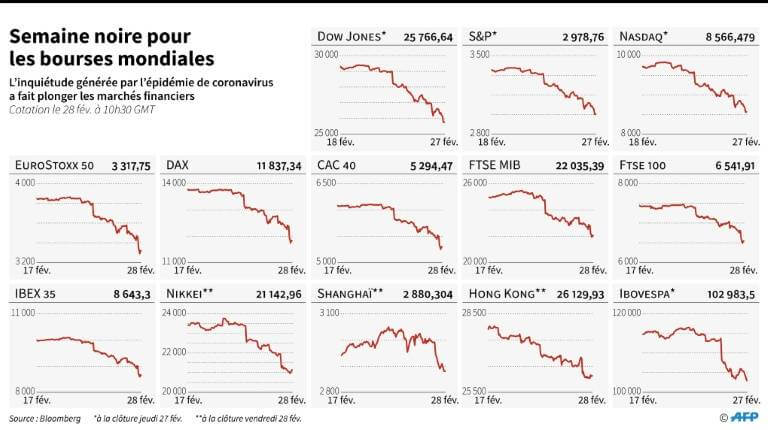

Financial markets at half-mast

The first consequence: the collapse of several stock markets. The coronavirus is considered a "black swan" for financial markets: unexpected bad news. And the effects were devastating: the world's stock markets experienced their worst week since 2008. Some stocks more or less withstood the shock, while others benefited. The reason is simple: if quarantines force people to stay at home, some companies will "profit" from the coronavirus.

The winners

The "winners" of the Coronavirus remain safe-haven equities, such as US Treasuries.

Other companies will also be positively impacted by the coronavirus, notably various streaming services: video (Netflix), music (Spotify) and delivery services.

The losers

As you might have guessed, the air transport and tourism sectors in general are the biggest losers from the Coronavirus in the stock market. Luxury goods and all sectors exposed to the Chinese market have been impacted by the fear that has invaded the financial markets.

Base metal prices exposed to the risk of a slowdown in China are down sharply: copper is down by almost 3%, nickel by more than 2.6%.

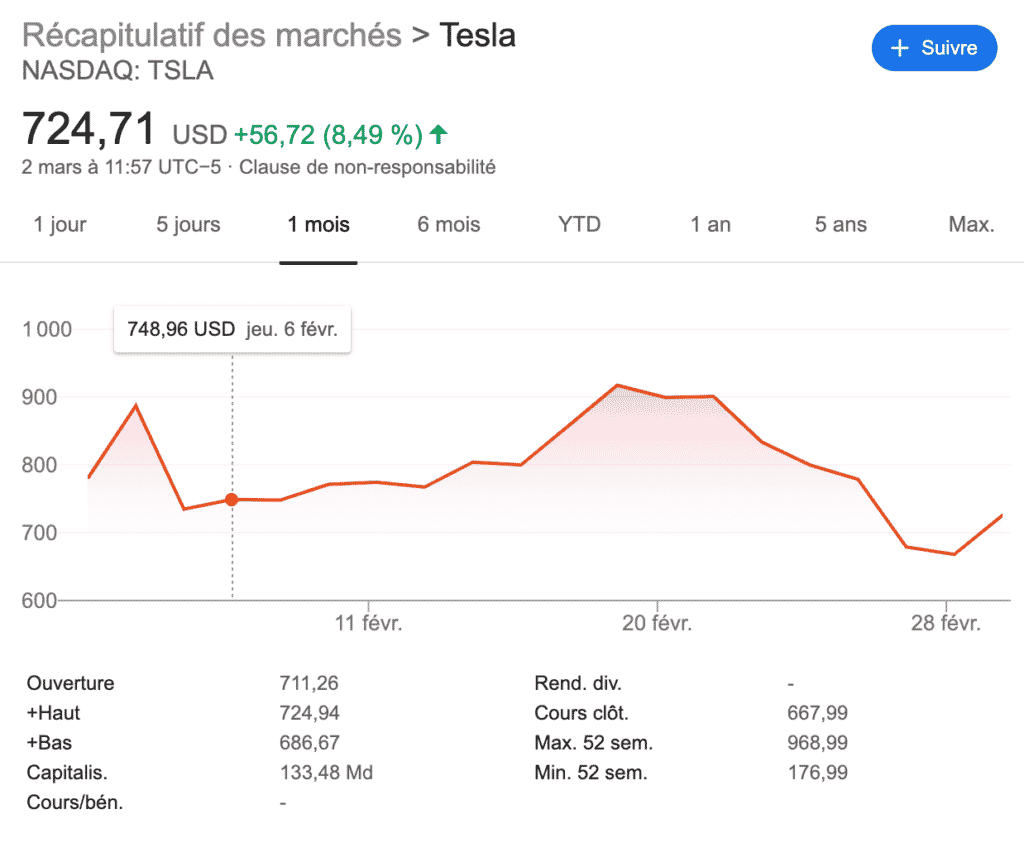

After soaring for months, Tesla's share price has plummeted due to the coronavirus. Why is this? Because the epidemic is delaying production of certain Tesla models, and will have a direct impact on the Californian giant's results.

"Deliveries scheduled for early February will be delayed. We will make up the production delay once the epidemic situation improves," said Tao Lin, Vice President of Tesla China. The impact on Tesla should be put into perspective: the Shanghai production site is new and did not account for a high percentage of Tesla's output. But what about other manufacturers?

Which brings us to our point: what impact will the coronavirus have on the automotive industry and delivery times?

China: the world's leading automotive producer and market

First of all, Tesla is far from being the manufacturer most affected by this crisis.

For decades, China has been the promised land of American, European and Japanese automakers. Today, the coronavirus epidemic threatens to prolong the fall in vehicle sales, derail production in the country and cripple global automotive supply chains.

Volkswagen (VLKAF), Toyota (TM), Daimler (DDAIF), General Motors (GM), Renault (RNLSY), Honda (HMC) and Hyundai (HYMTF) are just some of the global automakers who have invested heavily in China, forging partnerships with local companies and building vast production lines. China is not only the world's largest factory, but also the world's 1st largest automotive market.

The closure of car factories across China in January for the Chinese New Year vacation had already put the industry under pressure, but with the prolonged closures of many factories due to the virus, the impact on car production is likely to be even greater.

Protracted plant closures should make it even harder to emerge from the crisis

According to S&P Global Ratings, the epidemic will force Chinese automakers to cut production by around 15% in the first quarter. The automotive industry is particularly at risk, as the virus originated in one of China's "car cities". General Motors, Nissan (NSANF), Renault, Honda and Peugeot's owner, the PSA Group, all have major plants in Wuhan, which have been closed since the end of January.

Volkswagen is the most exposed brand. The world's largest carmaker has 24 car and parts production plants in China, which account for 40% of its output.

The world's second-largest automaker, Toyota, has also been affected. Toyota manufactures 15% of its cars in China. Admittedly, this is a smaller proportion than its rival Honda. But the delays are worrying.

"The situation varies depending on the plant and its parts supply. In addition, we have to take into account local and regional government directives, particularly with regard to logistics. We therefore cannot say with certainty whether we will resume plant operations from February 17," said a Toyota spokesman.

The crisis is already having an impact on Chinese manufacturers

Nio, China's largest electric car start-up, said on Monday that the coronavirus epidemic had contributed to the company's drop in sales last month. Nio sold just 1,598 vehicles in January, almost half of what it sold in December, and down 11.5% on January 2019. The comparison with January 2019 is particularly striking, as Nio sold just one vehicle at this time last year: the relatively expensive seven-seat ES8 electric SUV. Last June, Nio launched a more affordable five-seater SUV, the ES6, which appears to be a much more affordable vehicle...

And will impact the whole world

The longer the crisis drags on, the greater the risk of damage to global automotive supply chains. German engineering company Bosch, the world's largest automotive component manufacturer, has dozens of plants in China, including two in Wuhan. Other parts suppliers, including Schaeffler, ZF Friedrichshafen, Faurecia and Valeo, have significant operations in the country, according to S&P Global Ratings.

A Bosch spokesman said on Thursday that its factories in China remain closed on government orders, but that production should resume in many locations shortly but without specifying a date. The spokesman said it was still too early to assess the impact on the company.

China is also the global manufacturing base for electric motors, transmissions and other components for electric cars. Tesla (TSLA), which sources parts from several companies in China, has already stated that production will be delayed at its new Shanghai plant.

Time is running out for a major automaker. Hyundai (HYMTF) this week suspended production at its plants in South Korea because the coronavirus has disrupted its supply of spare parts. 29% of Korea's automotive supplies come from China....

But production is not the only factor to be taken into account when considering the impact of the coronavirus. The ban on gatherings will also have an impact on professionals and consumers.

Geneva Show cancelled

In Switzerland, the Federal Council has banned all events involving more than 1,000 people in the country until March 15 .

Consequence: The organizers of the Geneva Motor Show have decided to cancel the event due to the coronavirus (Yes. All pre-booked tickets will be 100% refunded ) .

But some 100% electric models will still be unveiled.

Maurice Turrettini, Chairman of the Foundation Board, said in a statement:

"We regret this situation, but the health of all participants is our top priority and that of our exhibitors. This is a case of force majeure and a huge loss for the manufacturers who have invested heavily in their presence in Geneva. We are confident, however, that they will understand this decision.

Several automakers have confirmed their intention to continue unveiling their electric vehicles via online presentations.

For example, BMW will unveil its BMW i4, its next electric car. Fiat-Chrysler was due to unveil its new-generation Fiat 500e electric car, but confirmed today that it had no plans to unveil the vehicle in any context other than the Geneva Motor Show. The automaker is said to be looking for alternatives to unveil its flagship city car.

Audi has released photos of its Audi e-tron S in anticipation of the show's cancellation. Renault has also released full details and press images of the electric car Twingo ZE. The French automaker is expected to do the same for the other models it had planned to unveil.

What impact will the coronavirus have on vehicle deliveries in France?

Delays. For the moment, that's the only certainty. If you ordered your vehicle a long time ago, there's a good chance that its delivery won't be affected by factory stoppages in China and elsewhere. But you'll have to be patient.

It's still too early to know the full implications of the coronavirus for the automotive market, but this crisis will have taught us one thing: all automotive companies have become dependent on China, and the risks are now more than ever shared.

We can't predict the next pandemic despite the world's best efforts, but it would be worth rethinking the global supply chain to limit the impact of this type of pandemic on the global economy.

If there is total containment, car dealers will be forced to close their doors until the end of this period.

What China's economic recovery tells us

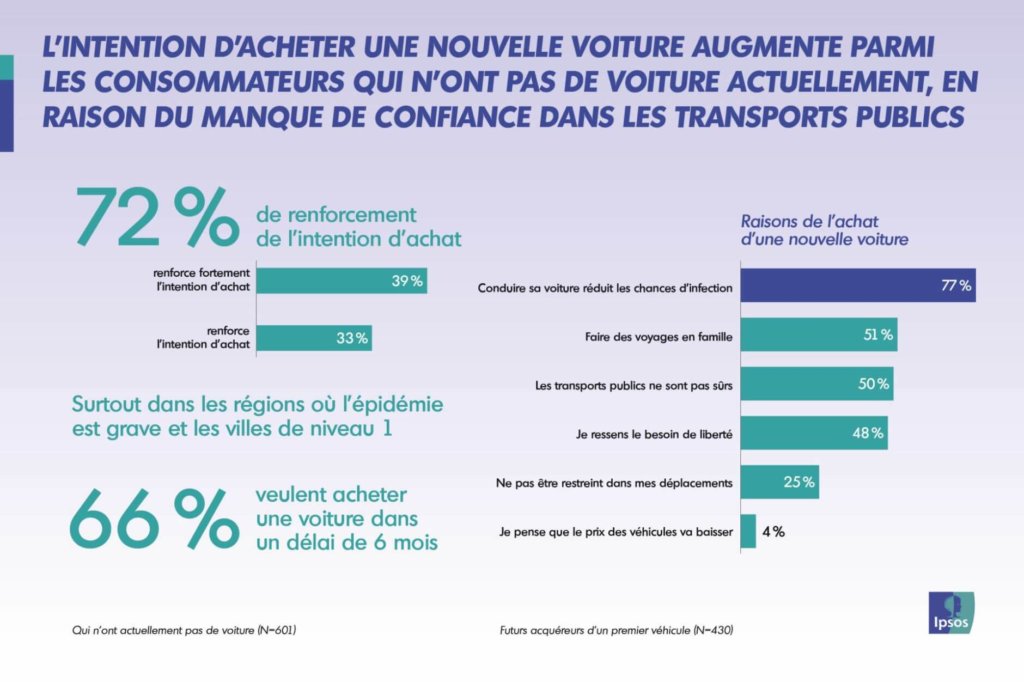

In China, the country is gradually getting back on its feet, and the aspirations of Chinese consumers give us some idea of what might happen during the recovery in France.

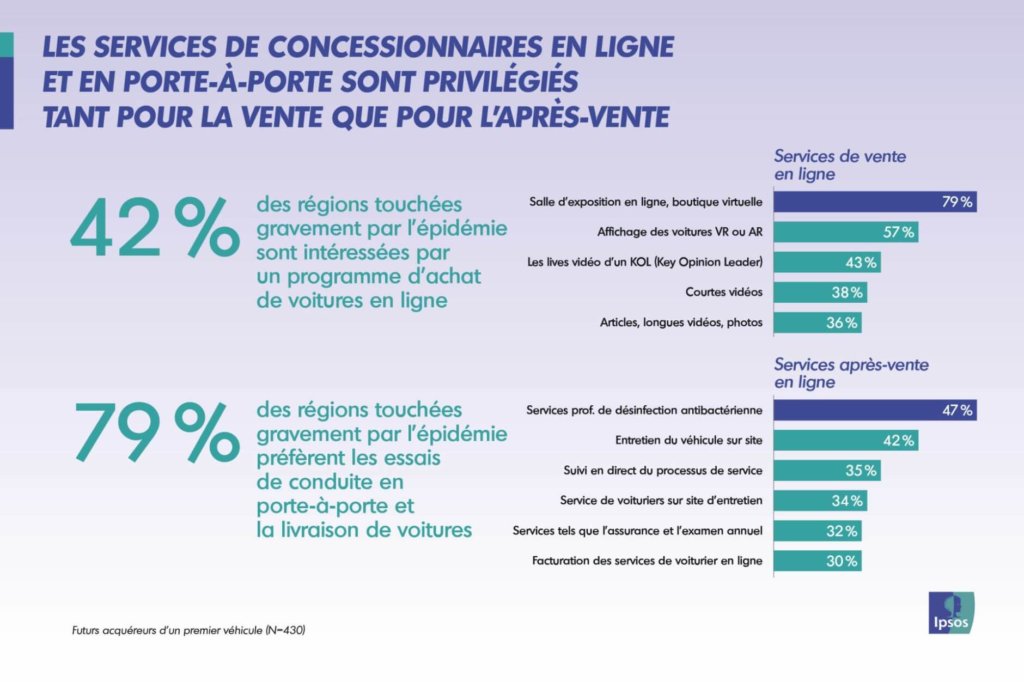

The firm Ipsosa French polling firm, has carried out a study of Chinese consumer habits post-Covid 19. The study shows that the virus has left its mark on the local population, helping to change their consumer habits, particularly when it comes to buying cars.

Key points from the study :

- People distrust public transport As the virus is easily transmissible, many Chinese no longer trust public transport, which has accentuated the spread of the virus. As a result, over 72% of Chinese living in the worst-affected regions and not owning a car would like to acquire one. The reason? To limit the risk of contamination in future pandemics.

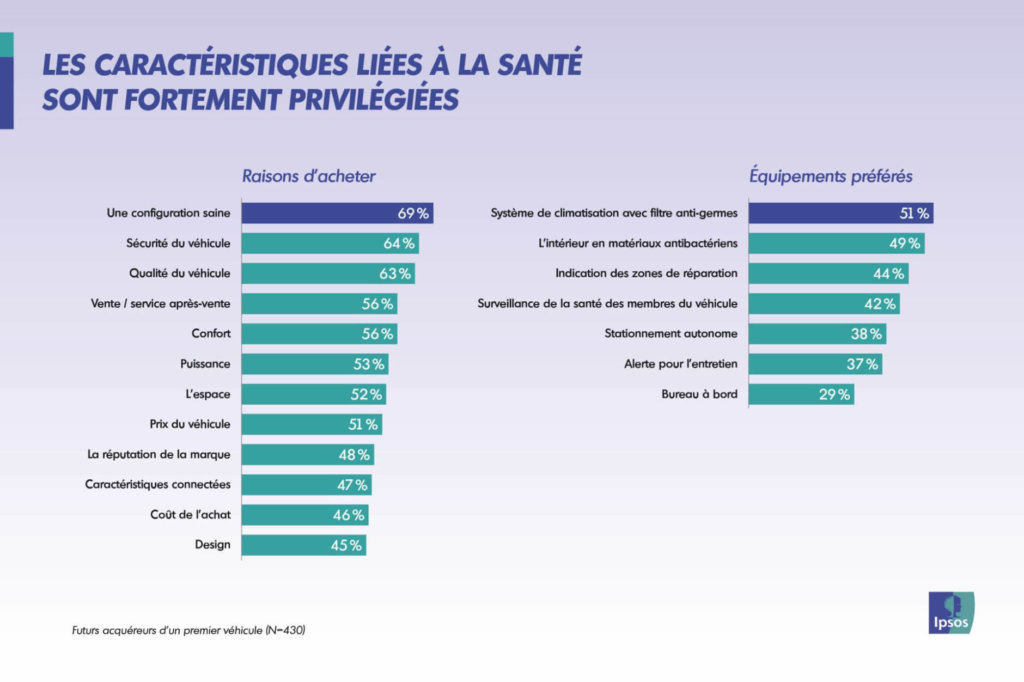

- Social distancing boosts e-commerce Here too, people who have experienced confinement are more likely to buy their next car online. 79% of potential buyers want more tailored services These include virtual visits, vehicles delivered to their homes for test drives, and even orders without test drives.

- The choice of options is also impacted by the virus: Chinese motorists want vehicles with options featuring anti-bacterial materials, for example.

Beev offers multi-brand 100% electric vehicles at the best prices, as well as recharging solutions.