Discover several models of electric vehicles available for quick delivery!

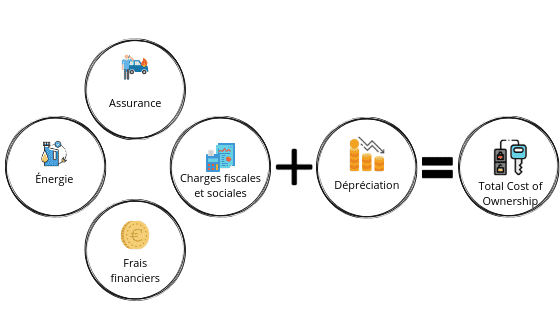

TCO (Total cost of ownership): definition

TCO (Total cost of ownership) represents the total cost of an asset.

TCO (Total cost of ownership) was invented invented in 1987 by the American consulting firm Gartner Group with the aim of reducing their customers' IT bills. The aim was to put a figure on the cost of IT equipment and try to reduce it.

In the case of car fleets, TCO (Total Cost of Ownership) is an estimate of the total cost of owning a car over a five-year period. It includes all expenses for fuel, insurance, maintenance, repairs, services, interest on the payment, as well as losses linked to the depreciation of the vehicle at the end of the same period.

How do you calculate your TCO (Total cost of ownership)?

An accurate TCO calculation can help a company determine when to replace fleet vehicles or consider the transition to leased vehicles. It's important to measure TCO carefully, as a misleading calculation can misrepresent the cost of your assets and lead to biased financial decisions.

In this article, we will calculate the TCO (Total Cost of Ownership), taking into account the following parameters:

- Capital

- Fuel costs

- Maintenance, assistance and insurance

- Administrative and tax expenses

- Depreciation

Depreciation: around 40% of TCO (total cost of ownership)

The value of your asset diminishes over time as it wears and deteriorates. Companies often calculate depreciation on the assumption that it will be valued at $0 at the end of its expected useful life. As a general rule, however, assets can be valued at 20% of their purchase price after five to six years of useful life, and at 10% of their purchase price after ten years.

When buying new assets, consider buying those with a lower depreciation rate so that they retain a higher residual value in the future once you're ready to sell.

Don't forget to to include vehicle registration and administration costs in your TCO (Total Cost of Ownership) calculation. These costs can vary from fleet to fleet. Take all associated costs into account in your calculations.

Fuel: Around 20% of TCO (Total cost of ownership)

The cost of fuel is generally the second largest expense item in the operation of a vehicle fleet. fleet operations. How to limit your fuel costs is a subject in itself. Fuel costs depend on a number of environmental and human factors:

- Gasoline and diesel prices

- Condition of cars and vans

- How drivers drive them.

The choice of engine - diesel, petrol, electric or hybrid - is fundamental to optimizing your costs. Commercial vehicles, for example, are largely dominated by diesel, as they often make long journeys. Smaller cars that do less driving will run on petrol.

Good to know: under-inflated tires can consume up to 15% more fuel. Make sure you keep a constant eye on them.

You can better control fuel costs by choosing to refuel at pre-selected service stations, or track each vehicle's fuel expenditure over time to optimize costs.

Beev's advice

- Choose vehicles with low CO2 emissions and low fuel consumption

- Measure your fuel consumption and look for cost-saving solutions.

- Think about driver training

- Keep tires inflated and vehicles in good working order

Insurance: Approx. 10%-15% of TCO (Total cost of ownership)

Obviously, cars and vans with a good insurance rating will cost less to insure overall.

Also, if you take out comprehensive insurance for the whole fleet vs. specific insurance for each vehicle, you'll save money.

Insurers have specific insurance policies for fleet vehicles. But before choosing an insurance policy, you need to know what the risks are: for example, if you choose an electric vehicle, you'll need to take out comprehensive insurance rather than conventional insurance.

To assess the risks associated with your vehicle fleet, you need to analyze your claims history and, based on the results, evaluate areas for optimization.

You can also integrate vehicle telematics for your fleet. What is telematics? It's a fleet management solution: drivers benefit from an intelligent, operational dashboard, and managers can exploit valuable data to help them make better management decisions.

Beev's advice

- Compare offers from all insurers to find the best deal

- Do an audit to find out which types of vehicle cost you the most

- Choose vehicles with low insurance rates

ALSO READ Electric car insurance: a guide to making the right choice

Capital

This is the initial investment, and it's the most neglected parameter, especially among SMEs who buy their vehicles with cash. Just because you buy the vehicle for cash without taking out a loan doesn't mean you shouldn't include it in your calculation. In fact, committing such large sums means losing out on investment opportunities and cash flow control.

A distinction must also be made between two cases:

- Large fleets

- Small fleets

The larger the company and the larger its fleet, the greater its negotiating power with the dealer. They achieve better economies of scale as a result, and can even negotiate for additional services included.

These "à la carte" contracts are less common for small fleets, which are keen to optimize their TCO (total cost of ownership) and ensure that the resale of their vehicle is commensurate with their investment.

Vehicle maintenance: around 5%-10% of TCO (total cost of ownership)

The cost of maintaining a vehicle or asset increases over its lifetime. And these costs increase exponentially as the asset ages. The cost of maintenance in year 7 is much higher than in year 1.

Maintenance and repair costs can have a significant impact on the cost of ownership and monthly lease payments.

What you can do is compare the offers made by car rental companies. These companies have a great deal of expertise in the vehicles they rent, and looking at what they offer will give you an idea of the price you'll have to spend on a vehicle.

For example, if two vehicles that sell for the same cash price have different leasing rates, you'll know that the vehicle with the higher leasing rate costs more to maintain.

Beev's advice

- Consider all-inclusive packages from rental companies

- If you're buying the car yourself, choose a reputable garage to get the best rates.

TCO calculations also include other costs, such as interest if you've chosen a bank loan, management fees or outsourcing costs. These costs vary from company to company, and should be added to your calculation.

Use the TCO simulator to calculate your car's total cost of ownership and compare it with its internal combustion equivalent.

How can the electric car impact your TCO (total cost of ownership)?

Summing up what we've seen above and what we know about the electric car, we can draw a few conclusions.

Let's take the example of an SME in need of a commercial vehicle. Commercial vehicles in France are mainly diesel-powered, so let's compare the two engines.

Diesel van | Electric van | |

Initial investment | ➕ | ➕➕ |

Insurance | ➕ | ➕➕ |

Maintenance | ➕➕➕ | ➕ |

Administrative and tax expenses | ➕➕➕ | ➕ |

Depreciation | ➖➖➖ | ➖ |

An electric commercial vehicle will cost you more than a diesel one, but given the current economic climate, you can save more by switching to a cleaner vehicle. It will be more cost-effective in terms of fuel and tax. Finally, a diesel commercial vehicle will no longer be able to sell on the second-hand market, whereas electric vehicles are selling much better than expected.

If you'd like to know more about depreciation, tax on the use of passenger vehicles for economic purposes (company vehicle tax) etc., read our article on the subject.

READ ALSO - Should you switch to an electric commercial vehicle?

In a nutshell

Choosing the right vehicles for your business is vital. It's also a strategic issue when you consider the costs associated with vehicles. By optimizing your TCO (Total cost of ownership) and choosing the right vehicles, you can free up significant sums for reinvestment in your company's growth.

For more information, we've put together a guide to this topic to explore the different aspects in depth:

Read our article about :

Want to go electric?

Beev offers multi-brand 100% electric vehicles at the best prices, as well as recharging solutions.