Our experts answer your questions with a smile

Monday to Friday

9h 12h30 - 14h 19h

China ready to conquer the European market

Indeed, the strategy put forward by Chinese automakers in the automotive world has been to buy up European brands, with the aim of entering the market with brand names that already resonate in the minds of European customers. Indeed, this strategy marks the beginning of massive Chinese capital investment in European automakers and in the development of Chinese electric cars.

Brands such as Lotus, Proton, MG, Volvo, LEVC (London cabs) and the tire brand Pirelli are all now owned by Chinese companies.

These investments are being made with the same ambition as in the Chinese market, where local regulations are very strict when it comes to introducing electric vehicles. For example, the Chinese government has set sales quotas for electric vehicles that will gradually increase from 10% in 2019 to 18% in 2023. This is encouraging Chinese automakers to bet heavily on electric vehicles, including in Europe, and is a notable example of the changes in trajectory being driven by Chinese capital.

Chinese electric cars coming to market

BYD

BYD is first and foremost a battery manufacturer. It is the world's 3rd largest battery manufacturer, after LG Chem and CATL in terms of production volume. The company entered the automotive sector in 2003 and quickly became a major player in the Chinese market.

In 2010, BYD was already the 4ᵉ largest Chinese electric car manufacturer in terms of number of vehicles sold, a performance that continues to grow thanks to the brand's strong investment in hybrid and electric vehicles. While BYD was the world's largest electric vehicle manufacturer until 2019, it is now Tesla that is narrowly ahead.

The competition between the two manufacturers is not over, however, with BYD now keen to export to the European and American markets, the land of dominance for Elon Musk's brand. If some of the design elements found on the brand's latest electric cars are reminiscent of Mercedes, it's because the two manufacturers have launched the joint Denza brand, based on Mercedes designs and the Chinese brand's 100% electric powertrains.

However,BYD is not best known for its electric passenger vehicles, but rather for its range of buses and trucks, which have electrified fleets in China and other cities around the world. Buoyed by this success, BYD opened a second European assembly plant near Beauvais in the Oise region (60) in 2018, following its first site in Hungary.

The BYD Han is the electric sedan chosen to start the offensive on the European market. This sedan with international ambitions is the fruit of 10 years' work, according to the Chinese brand, which intends to launch an entire range of 100% electric vehicles on the old continent.

The BYD Tang EV enters Europe via Norway, the brand's first full-scale trial in Europe's most mature market for electric vehicles. With its large SUV looks, it will come up against its European counterparts, the Jaguar I-Pace, Mercedes EQC and Volkswagen ID 4.

Range: 400 km

Battery capacity: 82.8 kWh

0 - 100 : 4.6 sec

Price: €70,800

Aiways

Born in 2017 as a start-up, Aiways has big ambitions for the European market. Claiming to be the first Chinese manufacturer to enter the European market with an electric SUV, Aiways is highlighting its German technologies. In fact, the brand has a research center in Ingolstadt, the home of Audi, the brand with the 4 rings. This new manufacturer is adopting a particular strategy to enter the European market. Aiways will use a network of local partners for vehicle testing and servicing. For sales, Aiways will use direct sales via its website, without going through a dealer network.

The Aiways U5 is the first electric vehicle sold by Aiways to enter the European market. TheAiways U5 has already logged many kilometers in Europe, especially in Corsica, where Hertz ordered 500 for the island. With its 400 km range, tourists and residents will be able to tour the island without worrying about their remaining range.

- Range: 410 km

- Battery capacity: 63 kWh

- 0 - 100 : 9.0 sec

- Price: €39,990 (excluding environmental bonus)

Discover the electric cars available from Beev

Geely (Polestar, Volvo)

2ᵉ Chinese carmaker, the Geely Group is at the helm of a significant number of Chinese brands such as Lotus, Lynk&Co, Polestar, Proton and Volvo. However, the brand also sells electric cars under its own "Geely" name. As mentioned above, the group is multiplying investments to develop its brand portfolio, becoming Volvo' s main shareholder in 2017 and acquiring almost 10% of Daimler (Mercedes) in 2018.

Today, the Geely Group is trying to establish itself in the European market with the Polestar and Volvo brands. Developed in Sweden, the group's new Chinese electric cars have great potential on the European market, with recognized brands and designs. Will your next Chinese electric car be a Volvo or a Polestar?

The Polestar 2 is the second Chinese electric car from the new Polestar brand. Although in the past the Polestar badge could be found on Volvo high-performance vehicles, since Geely's takeover of the Volvo Group, Polestar has become a fully-fledged Volvo entity dedicated to electric vehicles. The design, however, remains in keeping with the Swedish brand's codes, with an accent on sportiness.

- Range: 635 km

- Battery capacity: 78 kWh

- 0 - 100 : 4.7 sec

- Price: from €48,690 (excluding environmental bonus)

You're probably familiar with the Volvo XC40 P8 AWD Recharge, the electric version of the Volvo XC40 voted ''European Car of the Year 2018'' and launched on the market the same year. Using the same electric base as the Polestar 2, the XC40 offers over 400 horsepower and 400 kilometers of range. Volvo is also the first manufacturer to use Android Auto as the interface for its infotainment system, rather than rapidly outdated proprietary software.

- Range: 438 km

- Battery capacity: 78 kWh

- 0 - 100 : 4.9 sec

- Price: from €41,000 (excluding bonuses)

NIO

Today, the NIO range comprises 3 vehicles, with the ambition of exporting to North America and Europe. The Chinese brand is also renowned for its development of electric motors, thanks to its Formula E team. While Tesla invested early on in a Supercharger recharging network, NIO is developing a network of battery exchange stations in China. This system makes it possible to travel long distances without worrying about range. Available exclusively in certain major Chinese cities, it is also possible to order a van to come and recharge your NIO vehicle. Today, the NIO range comprises three electric vehicles, with the ambition of exporting to North America and Europe.

In China, NIO is positioned as a premium brand and has a definite following among the middle class in big cities, who are increasingly interested in Chinese electric cars. Since sales opened in 2018, NIO has sold over 50,000 electric cars, although the Covid crisis slowed sales in early 2020.

The launch vehicle for the NIO brand, the ES8 is a large 7-seater SUV. With a wheelbase of over 3 meters, the ES8 challenges the largest vehicles in its class, such as the Audi e-tron and the Tesla Model X. The ES8 is sure to make an impression in European cities where it will feel a little cramped.

- Range: 500 km

- Battery capacity: 100 kWh

- 0 - 100 : 4.9 sec

- Price: from €53,000

The NIO ES6 is the second vehicle from the Chinese electric brand, with a recognizable design and performance on a par with the best on the market. It's also the NIO brand's best-seller, featuring the manufacturer's new long-range battery. The ES6 is the 5-seater version of the ES8.

- Range: 480 km

- Battery capacity: 84 kWh

- 0 - 100 : 4.7 sec

- Price: from €45,000

The brand's latest model, the EC6, picks up on the coupé SUV trend seen, for example, on the new Audi e-tron Sportback. Based on the same chassis as the ES6, but with a different body, it offers even greater autonomy and a new glass roof.

- Range: 580 km

- Battery capacity: 100 kWh

- 0 - 100 : 4.5 sec

- Price: from €60,000

SAIC Motor (MG)

Chinese giant SAIC Motor is poised to become one of the world's top 10 automakers, just behind the Japanese, European and American giants. The company has a long history in China, with its origins in the repair workshops of Shanghai in 1955. At that time, SAIC was trying to reach the more affluent segments of the population.

The company quickly adopted a strategy of partnerships and alliances with other automotive groups. The sharing of intellectual property will enable SAIC to develop rapidly, with the support of local authorities.

SAIC is also General Motors' main Chinese partner, with whom it develops vehicles adapted to the Chinese market, enabling it to draw on GM's engine and transmission catalogs, while the Detroit-based company benefits from the experience SAIC is building around the electric vehicle.

To enter Europe, SAIC is pushing open the doors of brands acquired by the group. So it's with MG Motor, the former English brand known to Europeans, that SAIC arrives in Europe. The English brand's new Chinese electric cars make no secret of their origins in the Shanghai-based group. We saw branding made in SAIC on the side windows of the MG SUV.

https://youtu.be/CmxsCilR1VA

The MG ZS EV is the first Chinese electric SUV to be sold in Europe. The start of a multi-brand offensive driven by the giant SAIC, this SUV attacks the market from the heart of the range with the category most appreciated by European markets: small SUVs. Read our test drive to find out more about the MG ZS EV.

Our test - MG ZS EV test drive: The best electric SUV?

- Range: 440 km (WLTP)

- Battery capacity: 44.5 kWh

- 0 - 100 : 8.2 sec

- Price: from €17,490

The MG 5, known as the Roewe Ei5 in China, will be the first electric station wagon to be sold in Europe. While prices in China start at less than 20,000 euros, expect prices closer to 30,000 euros in Europe.

Once again, MG strikes a blow with this new MG 5 model, offering unbeatable value for money.

- Range: 400 km

- Battery capacity: 52.5 kWh

- 0 - 100 : 10 sec

- Price: from €25,990

Xpeng

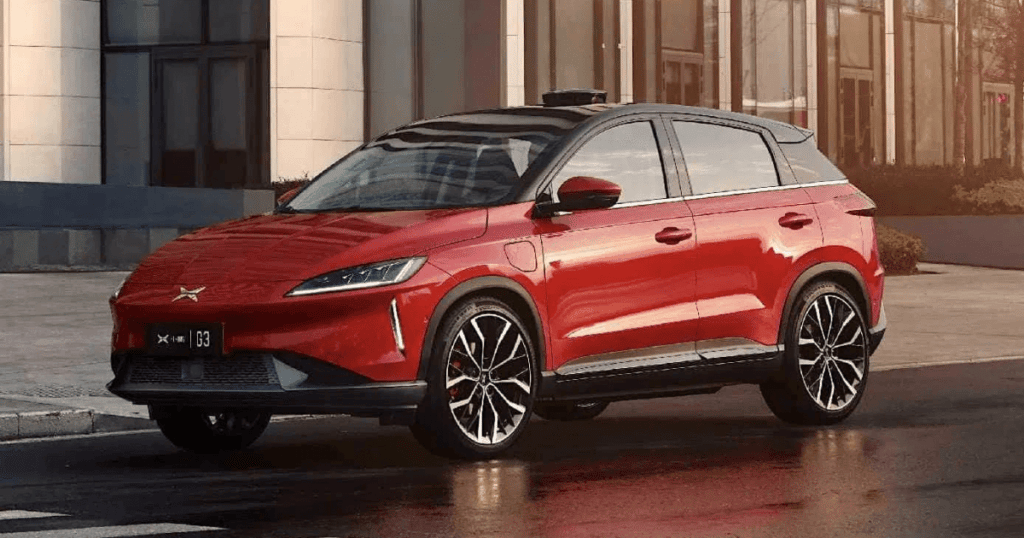

Xiaopeng Motors or Xpeng is a Chinese automotive company founded in 2014. Based in the Chinese city of Guanghzon, Xpeng is currently finalizing export tests on European versions of its two models, the G3 and the P7, starting with Norway.

Thanks to several successful fundraisings, Xpeng has been able to develop the industrial capacities needed to cover its local market and export internationally. Major Chinese investors such as the Xiaomi Group have also joined the venture.

Xpeng 's vehicles are differentiated by their premium positioning, while retaining a lower-category price.

For example, the Xpeng G3 SUV starts at less than 30,000 euros in China, despite a full range of equipment and the promise of autonomous driving in the next few years.

On the sales side, the Chinese brand is adopting the same strategy that made its American counterpart Tesla so successful before it.

Thus, the brand has showrooms in which it is possible to see the vehicle, and then all sales take place directly online. According to Xpeng, you can order your Chinese electric car in just a few minutes using the manufacturer's mobile app. The car is then delivered directly to the showroom or to the customer's home.

While the Xpeng G3 follows the market trend with its SUV format, it brings with it an unusual feature: a roof-mounted camera that can be raised to take photos anywhere around the vehicle. An accessory which, although not very useful, can double up as a reversing camera if required, or even as a surveillance camera when the vehicle is parked.

- Range: 451 km

- Battery capacity: 66.5 kWh

- 0 - 100 : 8.6 sec

- Price: from €34,000 (in China)

A premium sedan, the Xpeng P7 targets a market between the Tesla Model 3 and Model S. At launch, it is also the Chinese electric car with the highest range, with over 700 km on the old NEDC homologation cycle still used in China. This should still translate into over 500 km of range on the WLTP cycle.

- Range: > 500 km

- Battery capacity: 80 kWh

- 0 - 100 : 4.3 sec

- Price: from €42,500 (in Norway)

Not sure which car to choose?

Contact an expert

Chinese electric vans soon on our roads

The introduction of electric vehicles from China is not limited to passenger cars. The professional market also has a dynamic that Chinese manufacturers are keen to capitalize on. More and moreelectric vans, buses and even trucks will therefore be badged with a Chinese brand.

Still rare in France, more and more of them can be seen on the roads of Germany and the Netherlands, for example. We've also mentioned BYD 's bus and truck production plants in Hungary and near Beauvais in France. Although RATP would have preferred French manufacturers for its massive order of 800 electric buses, other European cities have opted for Chinese manufacturers. For example, BYD has won a mega-order for 259 electric buses from Dutch public transport subsidiary Keolis, to operate throughout the north-east of the country on urban and intercity routes.

Covid's impact on Chinese electric cars

During the Covid crisis, the global automotive market was hit hard. For some manufacturers, such as Renault, it was even the worst quarter in their history. In China, as in the rest of the world, the Covid crisis has raised awareness of air pollution. While several major Chinese cities regularly rank among the world's most polluted, the confinement of the population has brought a breath of fresh air into the heart of these cities. However, unlike in Europe, where the bicycle emerged as the big winner in terms of means of transport after the confinement, it's the car that has taken a leap forward in China.

According to an Ipsos study, 72% of people living in the regions most affected by contamination and who don't own a car would like to acquire one. For 48% of them, the safety factor is put forward in a context of social distancing.

China has taken advantage of this momentum in its automotive industry to promote electric vehicles through new subsidies and the use of existing aids. As a result, residents of major cities such as Shanghai have to wait several months or years to be allocated a license plate through a lottery system, and at a very high cost.

This system makes the exception of electric vehicles, which can receive a license plate immediately and free of charge. Faced with the urgent need to acquire vehicles, many Chinese motorists have turned to an electric vehicle model.

Buying habits have also changed, with almost one in two customers now saying they are ready to buy a vehicle online rather than at a dealership. Tesla' s contactless purchasing system, where customers can pick up their car and unlock it via the mobile app without having to go to a salesperson, has naturally been a big hit. In June, Tesla set a sales record in China, taking a 23% market share of all electric cars sold, with almost 15,000 deliveries from its new Chinese production plant.

China, a land of investment for carmakers

China is the world's largest automotive market, and it's only natural that it should attract the interest of all the major carmakers. Long blocked by a system of association, European and American automakers could not sell directly in China, but had to create joint ventures with local manufacturers. This is how alliances such as Dongfeng-PSA or SAIC-GM came into being. These joint brands not only enabled European vehicles to be sold on Chinese soil, but also the creation of new models exclusive to the Middle Kingdom. One example is the Denza brand, the fruit of a joint venture between BYD and Mercedes, which has created exclusive premium electric models using the resources of both companies.

Another example is the BMW IX3, whose production will take place in China, which will also be the first market to be able to order the Bavarian brand's new electric SUV. BMW is not alone in this situation, as French automakers are also relocating some of their product ranges, such as the latest DS 9, available as a plug-in hybrid, which is produced in Shenzhen.

The new model is aimed primarily at the Chinese market, as its positioning as a three-box sedan would suggest. Indeed, the tastes of the Chinese public are not the same as those of Europeans. However, one factor unites them: their desire to adopt cleaner vehicles.

It was with this strategy in mind that Renault completely abandoned the sale of combustion-powered vehicles in China, where the brand had never been a great success. The brand is now focusing exclusively on its zero-emission range in China, to attract a new, young, connected and urban clientele.

That's it! You know all about Chinese electric cars. What about you?