2035: the year when no combustion-powered vehicles will be allowed on the roads of the European Union.

Ten European countries, dozens of municipalities and five major carmakers have all announced their ambition to start promoting electric cars in the next few years.

Following the UK's commitment to phase out internal combustion cars from 2030, and ahead of the World Climate Summit in Glasgow in November 2021, all eyes are now on the European Union as it prepares its vast climate legislation package due in July.

Whether for economic, climatic or industrial reasons, the electric car is an ideal compromise for transport. One question remains: can the EU move to 100% electric vehicle sales by 2035, in order to meet the European "green contract"? That's what the BloombergNEF (BNEF) study set out to find out.

The study in brief

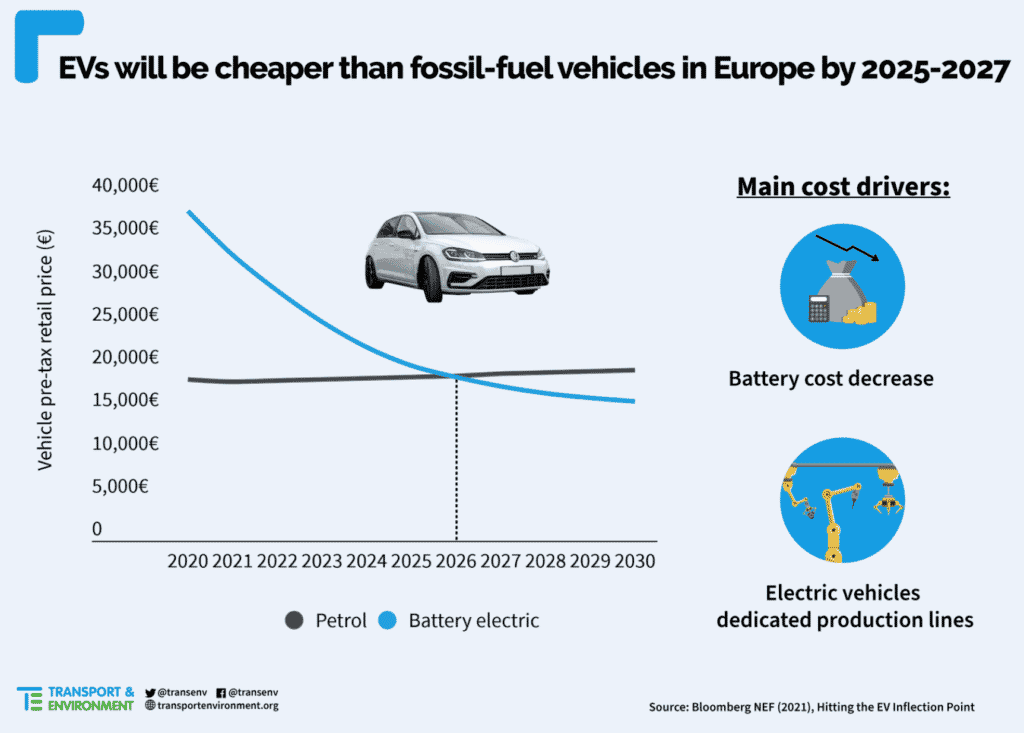

- Electric vehicles will reach the same price (excluding incentives) as equivalent gasoline-powered models between 2025 and 2027.

- The earliest electric vans will reach price parity is 2025.

- Small electric city cars will be the last in 2027

- Electric sedans and SUVs reach parity by 2026.

- In 2030, the average electric car will cost 18% less than the equivalent petrol car, excluding taxes.

Two main factors explain this price drop

- Firstly, falling battery prices, which are expected to drop by 60% over the decade (from €120/kWh in 2020 to around €50/kWh in 2030). The $100/kWh frontier, considered a key point for the affordability of electric cars, would be reached in 2024 (€80/kWh).

- The second major factor is the shift to production lines dedicated to low-energy electric vehicles (and to a new vehicle architecture), which enable automakers to cut costs by 10-30% through simpler assembly, standardized battery modules and other components, and higher volumes by producing several low-energy electric vehicle models on the same chassis.

These results lead to a clear conclusion: electric cars and vans will be the cheapest option in six years' time, saving EU drivers money as they make the transition to more sustainable mobility.

Electric vehicle adoption varies from country to country

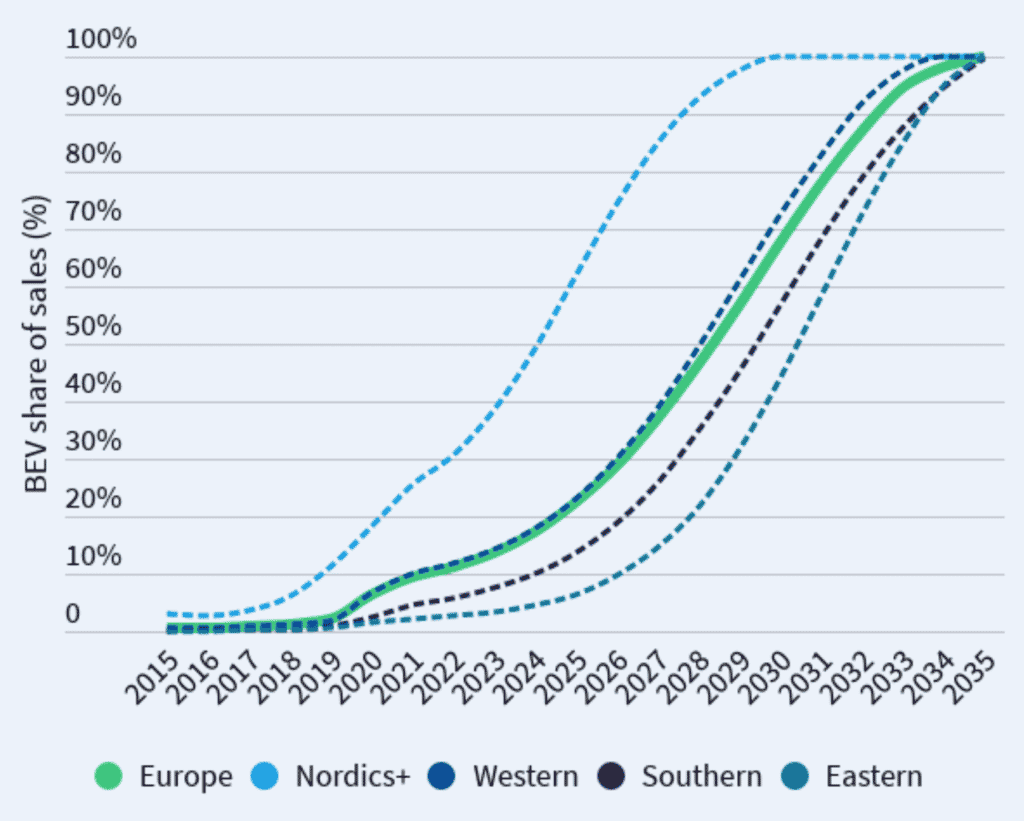

BNEF has modeled the possibility of moving to 100% pure electric vehicle sales across Europe, in the northern, western, southern and eastern country blocks.

The results show that, with adequate political support (what T&E calls the Green Deal scenario), thermal cars and vans can be gradually replaced in all European countries between 2030 and 2035.

To achieve this objective in the best possible way, sales of battery electric vehicles must reach :

- 22% of sales in 2025

- 37% of sales in 2027

- 67% of sales in 2030

Although sales are increasing considerably in line with these projections, not all EU member states are following the same trajectory.

The Nordic countries will be the 1st to achieve carbon neutrality for their vehicle fleets

- Northern Europe to reach 100% EVs by 2030

- Western Europe - which includes Germany, France and the UK - is expected to reach 100% EV ownership by 2034.

- This scenario is compatible with the UK's current commitment to a phased withdrawal, which only allows plug-in cars from 2030 and zero-emission cars from 2035.

- Germany is clearly the market leader in this group, and can achieve 100% zero emissions even sooner if it adopts ambitious policies.

- France has introduced EPZs

- Southern Europe (Italy, Spain and Portugal) follows a similar trajectory to the Western group, reaching total elimination of emissions one year later, in 2035.

- Finally, the battery-electric vehicle market in Eastern Europe (12 countries including Poland, Greece and Romania) is expected to grow fastest in the late 2020s, as these countries are starting from a long way off. As the second-hand market remains large, and the new car market represents only 10% of the EU total, growth in new electric car sales is slow in this region. However, very rapid adoption rates are expected around 2030 and beyond, as electric models become cheaper and more commonplace.

The law of supply and demand

The BNEF study also highlights the importance of rapidly stepping up production of electric vehicles.

Industrializing the production of electric vehicles is crucial to achieving the price inflexion expected for 2025-2027 in all light vehicle categories.

Current CO₂ targets for 2025 and 2030 for carmakers are well below the purely market-driven trajectory of the 2020s.

In short, the supply of electric vehicles needs to increase if the battery market is to operate at full capacity and drive prices down.

The role of governments in decarbonizing the vehicle fleet

Electric vehicle taxation must be advantageous for Europeans

In addition to supply-side regulation, other policies, such as appropriate tax incentives and the rapid deployment of recharging infrastructures, are needed to achieve the BNEF scenarios.

As far as taxation is concerned, the rapid growth in electric car sales means that heavy purchase subsidies are becoming financially unsustainable.

Instead, bonus-malus tax systems that use malus on CO2-emitting cars to pay for subsidies on zero-emission models - already in place in France, Sweden and Italy - are a far better way to steer car buyers away from CO₂-polluting engines and towards zero-emission models.

The network of charging stations needs to be expanded

An adequate and continuous recharging network - at home, at work, in public spaces and on freeways - is also essential. The European Infrastructure Act (AFID) should fill some of the gaps in this respect, notably by setting binding targets for all EU countries to ensure that Romanian and Polish drivers, not just German ones, have access to adequate public recharging infrastructure. However, as most recharging takes place in private places such as the home or workplace, there are many levers at national level to make the approval and installation process quick and easy.

This is why a direct link between AFID, on the one hand, and the ambition levels of European vehicle CO₂ standards, on the other, as recently suggested by the European automotive lobby, is not appropriate.

In conclusion

Europe clearly has the capacity to make its entire vehicle fleet 100% electric.

In some cases, such as corporate and municipal fleets, an electric car is already the best option today.

The current risk is that players in the EU automotive industry will not act fast enough in the 2020s to conquer the future market and develop the electromobility value chain (and corresponding jobs) in Europe. But this seems an unlikely eventuality, as manufacturers are all aware of the cause. Toyota, for example, has announced its first 100% electric SUV. The automaker was hostile to electric vehicles and bowed to pressure from its shareholders to offer 100% electric vehicles.