Electric car batteries

To better understand the European Union's approach, we need to go back to basics: what are electric vehicle batteries made of?

Once upon a time, there was an electric car

Cars have been a considerable asset for mankind: they enable us to get around, and for billions of people around the world, they are a means of locomotion that enables them to get to work, do their shopping and not depend on public transport, which is often non-existent in some parts of the world. But everything has its price. And the price of cars is twofold: they are often very expensive to maintain, but above all, they emit greenhouse gases linked to the combustion engine. Our way of life and our relationship with the car were untenable, and we had to find an alternative that would allow us to continue to move around freely while polluting less. That's where electric cars come in: they enable us to get around without emitting CO2 into the atmosphere.

Unlike a combustion engine vehicle, an electric vehicle emits no CO2 and has far fewer parts, making it easier to maintain.

The heart of an electric car is its battery. Unlike the batteries in most cars, which are mainly used to start the engine and run accessories like the radio or air conditioning, the battery in an electric car runs everything. More importantly, it powers the electric motor - or, more precisely, it powers a controller which in turn powers the electric motor - so it has to be powerful and durable enough to get drivers where they need to go with a minimum of recharging. Long considered too expensive, electric cars are becoming increasingly affordable. Not only have electric cars become affordable for more people, but even greater competition is now expected to drive down prices and costs.

Battery operation

A battery is a device for storing chemical energy and converting this chemical energy into electricity. A battery consists of one or more electrochemical cells, each of which is made up of two half-cells or electrodes. One half-cell, called the negative electrode, is overcharged with tiny, negatively-charged subatomic particles called electrons. The other, called the positive electrode, has a deficit of electrons. When the two halves are connected by an electric wire or cable, electrons flow from the negative to the positive electrode. We call this flow of electrons electricity. The energy of these moving electrons can be harnessed to perform a task - running a motor, for example. As the electrons move to the positive side, the flow gradually slows down and the voltage of the electricity produced by the battery drops. Eventually, when there are as many electrons on the positive side as on the negative side, the battery is considered "dead" and is no longer capable of producing a flow of electricity.

Electrons are generated by chemical reactions, and there are many different chemical reactions used in batteries available on the market. For example, the well-known alkaline batteries used in flashlights and TV remote controls generate electricity through a chemical reaction involving zinc manganese oxide. Most alkaline batteries are considered disposable. Once dead, they are useless and should be recycled. Car batteries, on the other hand, need to be rechargeable, so they don't have to be constantly replaced. In a rechargeable battery, electrical energy is used to invert the negative and positive halves of the electrochemical cells, thus restarting the flow of electrons.

How does an electric car battery work?

Lead-acid batteries

Carmakers have identified three types of rechargeable battery suitable for use in electric cars. These are lead-acid batteries, nickel-metal hydride batteries and lithium-ion batteries. lithium-ion batteries.

Lead-acid batteries were invented in 1859 and are the oldest form of rechargeable battery still in use. They have been used in all types of car, including electric cars, since the 19th century. Lead-acid batteries usually contain a mild sulfuric acid solution in an open container. The name comes from the combination of lead electrodes and acid used to generate electricity in these batteries. The main advantage of lead-acid batteries is that, after many years in use, they are well understood and inexpensive to produce. However, they produce dangerous gases during use, and if the battery is overcharged, there is a risk of explosion.

Nickel-Cadmium batteries

Nickel batteries came into commercial use in the late 1980s. They have a high energy density - meaning a large amount of energy can be packed into a relatively small battery - and contain no toxic metals, so they are easy to recycle.

Lithium-ion batteries

Lithium-ion batteries, which came onto the market in the early 1990s, have a very high energy density and are less likely than most batteries to lose their charge when not in use - a property known as self-discharge. Because of their light weight and low maintenance, lithium-ion batteries are widely used in electronic devices such as laptops. Some experts believe that lithium-ion batteries are the perfect rechargeable battery front-end, and that this type of battery is the best solution for boosting the electric vehicle market today. Virtually all new vehicles on the market are powered by lithium-ion batteries: Renault Zoé, Kia Niro EV, Nissan Leaf...

A variant of lithium-ion batteries, the lithium-ion polymer lithium-ion polymercould also prove valuable for the future of electric vehicles. These batteries could eventually cost less to manufacture than lithium-ion batteries; however, at present, lithium-ion polymer batteries are prohibitively expensive.

Now that we know how electric car batteries work, let's take a closer look at where the materials that make up these batteries come from and how they are manufactured.

The market for electric car batteries worldwide

To better understand the objectives of the Battery Airbus, we need to look at the global battery market. The global battery market for electric vehicles (EVs) was estimated at $23 billion in 2017, and is expected to reach $84 billion by 2025.

A fast-growing market

In recent years, consumers have been more inclined to opt for electric vehicles or plug-in hybrids. There are several reasons for this: electric vehicles don't need fuel (petrol or diesel) and have lower maintenance costs, potentially reducing consumer outgoings. What's more, a growing awareness of environmental issues is driving consumers to adopt less polluting vehicles.

According to Averethe market for electric vehicles is growing steadily: in June 2019, the number of registrations rose by +46% in France.

Growth in the electric vehicle (EV) battery market is fuelled by increasing demand for zero-emission vehicles, falling battery production costs and growing awareness of climate change worldwide.

This market represents significant, but so far untapped, potential for European battery manufacturers and automakers, as well as for the European economy in general. Currently, the EV battery market is dominated by players from just three countries, all in Asia: China, Japan and Korea. In 2018, less than 3% of total global demand for EV batteries was allocated by companies outside these three countries, and just 1% by European companies.

China dominates the commodities market

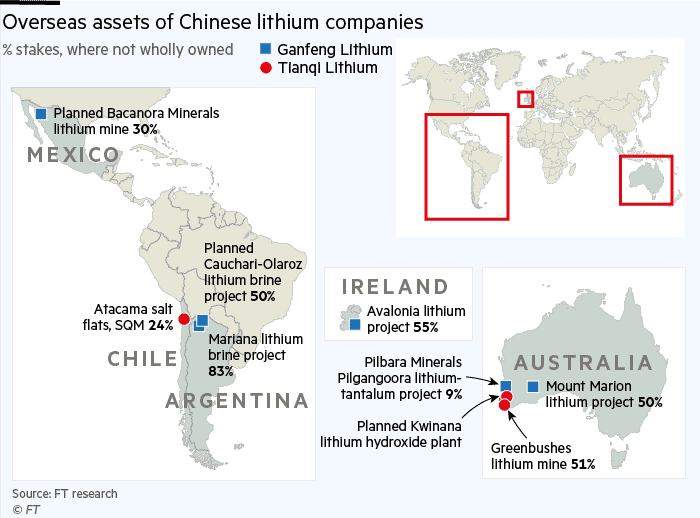

In China, lithium production plants resemble oil refineries. In just a few years, Chinese companies have become among the world's largest producers of lithium, a light metal that is an essential raw material for batteries. They have bought up mines from Australia to South America and are building factories in China to manufacture lithium chemicals and batteries.

The latest example of China's ability to channel prodigious amounts of capital into fast-growing industries, the country produced over 60% of the world's lithium in April, compared with less than 1% for the USA, according to Benchmark Mineral Intelligence.

China's dominance of the electric car supply chain has sparked growing concern in a trade war that obsesses Washington and Brussels, both fearful of being squeezed out of the next industrial revolution. In early May, two US senators, Lisa Murkowski and Joe Manchin, proposed a bipartisan bill to boost US production of essential minerals such as lithium.

But that hasn't always been the case

Yet for most of the 20th century, the USA was the world's largest lithium producer, but the Kings Mountain mine in North Carolina closed in the 1980s, due to competition from Chile. After that, the market was dominated by a few players known as the "Big Three": Chile's SQM, which was controlled by the son-in-law of the country's former dictator, Augusto Pinochet, and US producers Albemarle and FMC. In 2015, Albemarle acquired rival US producer Rockwood, and last year FMC spun off its lithium business into a separate entity, Liventlisted in New York.

This poses a problem for European manufacturers

With limited battery supply options in Europe, European automakers have so far largely secured their supplies by signing long-term agreements with Asian producers. Some leading European OEMs, for example, have so far ruled out any further investment in cell production, concentrating solely on R&D and packaging. Nissan currently owns a plant in Sunderland, UK, but is looking to dispose of it. Volkswagen has just announced that it is investing €1 billion in a battery cell manufacturing plant it is developing in partnership with SK Innovation in Germany, while it also has major supply contracts with LG Chem, Samsung and Chinese battery manufacturer CATL.

By choosing not to produce batteries themselves and failing to secure supplies close to their European factories, European carmakers risk finding themselves at a disadvantage to rival manufacturers who are closer and better able to secure battery supplies as demand for EVs grows. As a result, there may be lucrative opportunities for battery manufacturers who establish facilities in the right place at the right time.

This is where the Airbus battery project comes into its own: to remain competitive in the electric vehicle market, Europe needs to develop its own electric car batteries.

EU calls for "battery Airbus" to advance electric car technology

And to counter China's major influence in this sector.

Back in 2017, at the 30th International electric Vehicle Symposium & Exhibition in Stuttgart, European Commission Vice President for Energy Maros Sefcovic declared that "Europe as a whole has been at the forefront of all the great transport revolutions of the past - railroads, combustion engines, aviation. I am convinced that the European automotive industry can lead the way in the global transition to clean, connected mobility. I'm certain that Europe can become the continent of intelligent, clean automotive infrastructures. We are better equipped than any other part of the world to make this giant leap. We need to work together to make it happen."

This wish became a reality at the end of 2019, with public funding of €3.2 billion to develop a "battery Airbus".

The aim of the Battery Airbus is clear: to catch up with Asian countries and give Europe a competitive edge in this new mobility revolution.

The European Commission has given the green light to the Airbus of batteries. The project will be supported by seven EU member states - Belgium, Finland, France, Germany, Italy, Poland and Sweden - with an overall deadline of 2031. The project is expected to attract an additional €5 billion in private investment.

The "important project of common European interest" (Piiec) will be the fruit of collaboration between several sectors: automotive (BMW), chemicals (BASF and Solvay) and several small European companies.

Future batteries will be safer and more environmentally friendly. In-depth work will also be carried out to increase their lifespan and reduce their recharging time.

Now you know all about the Airbus of batteries. If you have any questions, please don't hesitate to contact us at [email protected].