Taxation: definitions

Lataxationis often a complex subject. Laws change with each government and it's complicated to keep up to date.

Taxation is the set of rules put in place by the State or local authorities to collect taxes and other compulsory levies.

To sum up, taxation is a framework put in place by the State to collect recurring income to finance the needs of the country in which you work and live.

Nevertheless, the taxation Being a set of rules, if you manage to master these rules you can no longer be subjected to them but can turn them to your advantage. This is particularly the case for company vehicles.

We're going to take a look at the tax rules that will be of interest to you if you have one or more vehicles for your company and want to understand what's at stake and how you can optimise your situation.

Comparative table for the 2023 vs 2024 ecological bonus

| Ceiling 2023 | Ceiling 2024 | |

|---|---|---|

| New electric or hydrogen car (1) - RFR> €15,400(5) | 5 000 € | 4 000 € |

| New electric or hydrogen car (1) - RFR≤ €15,400(5) | 7 000 € | 7 000 € |

| New electric or hydrogen car (1) - legal entity | 3 000 € | - |

| Used electric or hydrogen cars | 1 000 € | - |

| New electric or hydrogen-powered light commercial vehicle (2) -RFR > €15,400(5) | 6 000 € | 5 000 € |

| New electric or hydrogen-powered light commercial vehicle (2) -RFR ≤ €15,400(5) | 8 000 € | 8 000 € |

| New electric or hydrogen-powered light commercial vehicle (2) - legal entity | 4 000 € | 3 000 € |

| Used electric or hydrogen-powered light commercial vehicles | 1 000 € | - |

| New 2 or 3-wheel vehicle or electric quadricycle (3) ≤ 3 kW | 100€ | 100€ |

| New 2- or 3-wheel vehicle or electric quadricycle (4) ≥ 3 kW | 900€ | 900€ |

Vehicle taxation: Commercial vehicle or passenger car? How do you choose?

When we talk about taxation In terms of vehicles, there are two types of company vehicle that will have a major impact on the taxation of your vehicle fleet.

- The commercial vehicle (CV) : a vehicle designed to carry goods, not people.

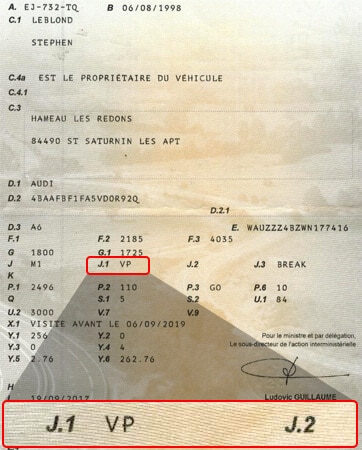

- Le commercial vehicle must meet a set of specifications to obtain LCV status in field J1 of the vehicle registration document.

- Must have a maximum of 2 front seats.

- Do not have a rear bench seat or anchorage points that allow the rear seats to be used.

- Passenger cars A vehicle designed to carry people rather than exclusively goods.

- The passenger vehicle, whose acronym is VP (véhicule particulier) on the J1 field of the vehicle registration document, can carry a maximum of 9 people, including the driver.

Lease an electric car

Would you like to lease an electric car? Beev offers you 100 % electric cars at negotiated prices, as well as recharging solutions.

Depreciating your vehicle: the rules in force

A company can depreciate a number of assets. Most people are familiar with the principle of depreciation for computers, but not so much for vehicles. If you buy a new vehicle in 2024, here are the tax rules that apply.

Under the new Senate "The aim is to provide companies with a tax incentive to buy low and very low emission vehicles in order to speed up the greening of the French car fleet. Weconsiders that more than 50 % of new vehicles put on the road belong to companies or public administrations. Of these vehicles, 79 % are diesel vehicles and only 4 % are electric and hybrid vehicles."

Your vehicle will lose value over time as you use it.Depreciation takes into account the depreciation of your vehicle over time: it can then be considered as a charge for your business.This charge is the loss in value of an asset over time (the asset being your vehicle).

To understand :

Profit = Sales - Expenses

In simple terms, depreciation is an expense, so it will reduce your profit and therefore reduce your corporation tax. The depreciation rules for vehicles are different, whether you have a commercial vehicle or a passenger car.

The simplest case : the commercial vehicle. The depreciation base is 100 % over a period of 4 to 5 years.

Example I bought a new commercial vehicle for €20,000 in January 2024. The depreciation period is 4 years.

Annual depreciation will be €20,000/4 = €5,000. In my income statement, the charge to my company will therefore be €5,000.

The most complex case yet, the passenger vehicle. They are governed by the taxation the rules put in place by the government. France's aim is to make the French car fleet ever cleaner, through a tax policy that is more or less advantageous depending on the vehicle.

The depreciation basis depends on the year the vehicle was purchased and its CO2/km emission rate. The basis for depreciation varies according to the vehicle's CO2 emissions, based on the following scale.

| Plafond | Véhicules de tourisme acquis ou loués mis en circulation à partir de 2021 |

|---|---|

|

30 000 €

|

< 20 g CO2 / km

|

|

20 300 €

|

From 20 g to 50 g of CO2 / km

|

|

18 300 €

|

From 50 g to 160 g of CO2 / km

|

|

9 900 €

|

> 160 g CO2 / km

|

Worth noting The depreciation ceilings below for 2024 remain unchanged from those for 2021.

Can VAT on a company car be reclaimed?

Can VAT on a company car be reclaimed? What about electric cars? What are the conditions and exceptions?

La taxation and electric vehicles has already been covered in our articles on the subject. We are now going to look at VAT on company cars.

A brief history of VAT

VAT or Value Added Tax is a consumption tax invented in France in 1954. Before VAT was introduced, businesses were subject to taxes, which they passed on in their selling prices. The problem was that the more intermediaries there were, the higher the price.

With VAT, regardless of the number of intermediaries, the end consumer pays the same tax, i.e. generally 20 % of the price excluding VAT of the product.

The purchaser therefore pays VAT to the company from which he buys the product and not to the State.

Each of the companies involved in the production of the product purchased will then pay this tax to the State.

Let's take a concrete example:

You buy equipment for €24,000 including VAT. In this case, the VAT is €4,000.

The seller will collect €4,000 in VAT (output VAT).

The seller then deducts the VAT that his suppliers charge him on the purchase of the goods, known as deductible VAT, and pays the difference to the government.

However, the concept of VAT is different for company cars.

Is it possible to reclaim VAT on a company electric car?

In theory, no. VAT is not recoverable on private cars for business use, regardless of how they are purchased (long-term rental, lease with purchase option or cash purchase).

If the employee buys the car on a personal basis for business use and is therefore entitled to mileage allowancesVAT will be payable. The company cannot reclaim VAT.

Exceptions

You can reclaim VAT if you buy commercial or company vehicles, regardless of how they are purchased (long-term rental, lease with purchase option or cash purchase) :

- commercial vehicles (CUVs) or light commercial vehicles (LCVs).

- industrial vehicles (VI).

- private vehicles (PS), but only if they are used for driving lessons or passenger transport (taxi, VTC).

- passenger cars for hire.

- 2-seater derivatives of passenger cars (PCs), provided that the registration document specifies the name van (CTTE) or 02 for the number of seats.

VAT can be reclaimed if the car is resold to a second-hand car dealer.

When you sell your vehicle, the sale of an asset that has not given rise to a right to deduct VAT is exempt from VAT (article 261-3-1° of the General Tax Code). The buyer of a company car will therefore not be able to deduct any VAT.

In the specific case of resale to a used vehicle dealerIn some cases, the company can reclaim part of the VAT originally paid.

Note that a dealer can reclaim VAT if the car has always been owned by companies before.

Can VAT on fuel be reclaimed?

Yes, VAT can be reclaimed on fuel, but at different rates for different types of fuel.

| Carburant | TVA récupérable |

|---|---|

|

Diesel

|

80 %

|

|

LPG (Liquefied Petroleum Gas: a mixture of butane and propane)

|

100 %

|

|

CNG

|

100 %

|

|

Electricity

|

100 %

|

In addition to VAT, companies benefit from a taxation advantageous electric cars:

- Nothe tax on the use of passenger vehicles for economic purposes.

- Exemption from registration fees.

- Depreciation basis of €30,000.

Tax on the use of passenger vehicles for economic purposes

What is the amount oftax on the use of passenger vehicles for economic purposesfor electric cars?

Latax on the use of passenger vehicles for economic purposes is a tax levied on a company's private vehicles. How is it calculated? How much does it cost per year? What about electric cars? That's what we'll be looking at together in this section.

Tax on the use of private cars for economic purposes: definition

To put it simply,tax on the use of passenger vehicles for economic purposesis a tax levied on companies that have their registered office in France or an establishment in France. This tax applies to the passenger vehicles they use, own or hire.

What is a passenger car?

This is a vehicle designed to carry people. It has a maximum of 9 seats, including the driver. It has a rear bench seat and can carry more than 2 people. It is labelled a passenger car on the J.1 section of your vehicle registration document.

Latax on the use of passenger vehicles for economic purposesis payable each year to the Service des Impôts des Entreprises (SIE).

It is calculated according to several criteria:

- the vehicle's CO2 emissions,

- the date of entry into circulation,

- vehicle fuel (diesel, petrol).

How is the tax on the use of private cars for business purposes calculated?

Latax on the use of passenger vehicles for economic purposes (formerly TVS) is the sum of two components:

- 1ʳᵉ component: A rate applied according to the CO2/km emission rate.

| Taux d'émission de CO2 (g/km) | Tarif marginal |

|---|---|

|

Up to 12g/km

|

0 €

|

|

13 to 45 g/km

|

1 €

|

|

45 to 52 g/km

|

2 €

|

|

53 to 79 g/km

|

3 €

|

|

80 to 95 g/km

|

4 €

|

|

96 to 112 g/km

|

10 €

|

|

113 to 128 g/km

|

50 €

|

|

129 to 145 g/km

|

60 €

|

|

More than 146 g/km

|

65 €

|

- 2ᵉ component: A tariff based on emissions of atmospheric pollutants

The aim of this component is to tax the most polluting vehicles according to their fuel. Diesel pollutes more than petrol, so it is taxed more heavily.

| Année de mise en circulation | Essence | Diesel | Electrique |

|---|---|---|---|

|

2011 à 2014

|

45 €

|

100 €

|

0 €

|

|

2015 to present

|

20 €

|

40 €

|

0 €

|

Latax on the use of passenger vehicles for economic purposesis the sum of the two components.

Example : I bought my new car in January 2019, which emits 138 g/km of CO2 and runs on diesel.

Tax on the use of passenger vehicles for economic purposes = 1ʳᵉ component + 2ᵉ component

= (138 * 6,50) + 40

= €937/year

Which vehicles are covered by the tax on the use of private cars for business purposes?

Latax on the use of passenger vehicles for economic purposesconcerns certain types of vehicle:

- vehicles registered in the "PC" category.

- multi-purpose vehicles classified in category "N1" and intended for the carriage of passengers and their luggage or goods.

- vehicles with at least 5 seats whose European body code is pick-up trucks.

(A seat is considered to exist if the vehicle is equipped with "accessible" anchorages, i.e. anchorages that can be used.)

Good to know commercial vehicles of the van or van are not covered by the passenger car classification.

In short, if the vehicle :

- If your vehicle is used to transport goods, you do not pay the tax on the use of passenger vehicles for economic purposes.

- transports people, you are liable for tax.

The tax on the use of passenger cars for economic purposes for electric cars

Electric vehicles are not subject to the tax on the use of passenger cars for economic purposes.

This exemption only applies to vehicles emitting less than 20g/km of CO2.

As we saw above, the tax on the use of passenger cars for economic purposes is the sum of the two components. The calculation for electric cars is therefore different.

Example : I bought my electric vehicle in January 2019, which emits 0 g/km of CO2 and runs on electric power.

Tax on the use of passenger vehicles for economic purposes = 1ʳᵉ component + 2ᵉ component

= 0 + 0

= 0 €

What other vehicles are exempt from tax on the use of passenger cars for business purposes?

In certain cases, you are exempt from tax on the use of private cars for business purposes:

- transport vehicles available to the public (taxis and VTCs, for example);

- vehicles intended exclusively for sale (cars owned by car dealers, for example);

- vehicles accessible to the disabled When a vehicle is accessible to a disabled person, it comes under category M1, which means it is exempt from tax on the use of passenger vehicles for economic purposes.

- vehicles using a combination of petrol and natural gas, fuel or liquefied petroleum gas are permanently exempt (if the CO2 emission rate is less than or equal to 50 g/km) or temporarily exempt (if the CO2 emission rate is between 60 and 100 g/km) from the first component of the tax rate.

- vehicles for hireif the company's object is vehicle rental;

- vehicles used exclusively for teaching purposes driving lessons (driving schools) or sporting competitions (except for companies offering driving lessons on circuits, which are taxable);

- vehicles intended exclusively for agricultural use (passenger vehicles).

Electric vehicles are therefore exempt from this charge for businesses. But this is not the only tax advantage of electric vehicles. Don't hesitate to consult our file on the taxation to find out more.

See also - TCO (Total cost of ownership): how can it be calculated and optimised?

Bonus: amortisation of the battery of electric vehicles

Yes, you read that right, it is possible to write off the battery of your electric vehicle, which is considered to be part of your vehicle's equipment and can therefore be written off on the basis of an invoice sent by your dealer.

The battery's damping base is located between €10,000 and €26,000 depending on the power of the battery and can be carried out either over one year or over the period of ownership of the vehicle.

The battery can be written off, whatever its value, provided that it is shown either :

- on the vehicle purchase invoice, depreciation will be taken from the date of acquisition to the company's financial year-end, or over a period of 5 years or less

So be it,

- on a separate invoice, which has the advantage of not being subject to a ceiling on tax-deductible depreciation.

- 30,000 for the vehicle

- 12,000 for the battery

- still €30,000 for the vehicle.

- 13,000 for the battery.

Taxation of internal combustion vehicles VS electric vehicles

| Véhicule Diesel | Véhicule Électrique | |

|---|---|---|

|

Base price

|

33 000 €

|

33 000 €

|

|

CO2

|

138 g/km

|

0 g/km

|

|

Tax on the use of passenger vehicles for economic purposes

|

937 €/year

|

0 €/year

|

|

Depreciation basis

|

9 900 €

|

30 000 €

|

|

Battery damping

|

0 €

|

+ 10 000 €

|

Taxation of electric vehicles will therefore be more advantageous in 2024.

As well as saving money on fuel, you can take advantage of an attractive tax policy:

- Depreciation base maintained at €30,000 for electric vehicles.

- No tax on the use of passenger vehicles for economic purposes.

- Exemption from registration fees in most regions of France.

- You may be able to write off the battery of your electric vehicle.

In a nutshell

Before you choose your next company car, make sure you know all about its tax status. In addition to a good image and fuel savings, the electric car represents a real tax opportunity for you, now that you understand the rules of the game. Taxation of electric vehicles is an opportunity for your business and it would be wise to start looking into it.

See also - TCO (Total cost of ownership): how can it be calculated and optimised?