A short history of VAT

VAT or Value Added Tax is a consumption tax invented in France in 1954. Before the introduction of VAT, companies were subject to taxes, which they passed on in their selling prices. Problem: the more intermediaries there were, the higher the price.

With VAT, regardless of the number of intermediaries involved, the end consumer pays the same tax, which is generally 20% of the product's price excluding VAT.

The buyer therefore pays VAT to the company from which he buys the product, and not to the State.

Each of the companies involved in the production of the purchased product will then pay this tax to the State.

Let's take a concrete example

You buy equipment for €24,000 including VAT. In this case, the VAT is €4,000.

The seller will collect €4,000 in VAT (output VAT).

The seller then deducts the VAT charged by suppliers on the purchase of goods, known as deductible VAT, and pays the difference to the government.

However, the VAT concept is different for company cars.

Is it possible to reclaim VAT on a company electric car?

In theory, no. VAT is not recoverable on private cars for business use, regardless of the method of purchase (long-term leasing, leasing with purchase option or cash purchase).

If the employee buys the car on a personal basis for business use, and is therefore entitled to mileage allowancethey will have to pay VAT. The company cannot reclaim the VAT.

The exceptions

You can reclaim VAT if you purchase commercial or company vehicles, regardless of the method of purchase (long-term leasing, leasing with purchase option or cash purchase).

- Commercial vehicles (CUVs) or light commercial vehicles (LCVs)

- Industrial vehicles (VI)

- Private vehicles (PS), but only if they are used for driving lessons or personal transport (cab, VTC).

- Passenger cars for rental

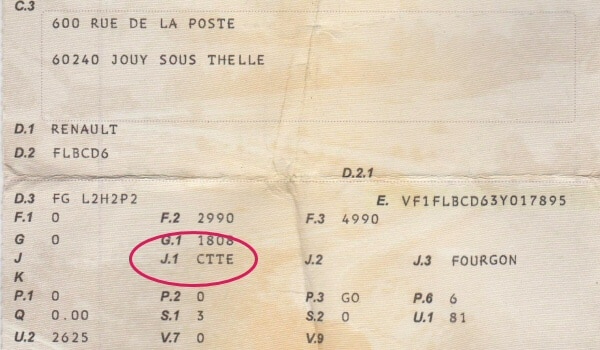

- 2-seater derivatives of passenger cars (PCs), provided that the vehicle registration document specifies the name van (CTTE) or 02 for the number of seats.

VAT can be reclaimed if the car is resold to a used-vehicle dealer.

When you resell your vehicle, the sale of an asset that has not given rise to a right of deduction is exempt from VAT (article 261-3-1° of the French General Tax Code). The buyer of a company car will therefore not be able to deduct any VAT.

In the specific case of resale to a used vehicle dealerthe company can sometimes recover part of the VAT initially paid.

Note that a dealer can reclaim VAT if the car has always been owned by companies before.

Is it possible to reclaim VAT on a company electric car?

Yes, VAT can be reclaimed on fuel, but with different rates for different types of fuel.

Fuel | Recoverable VAT |

Diesel | 80 % |

LPG (Liquefied Petroleum Gas: a mixture of butane and propane) | 100 % |

GNV | 100 % |

Electricity | 100 % |

In addition to VAT, companies also benefit from tax advantages for electric vehicles (EVs).

- No TVS

- Exemption from vehicle registration fees

- Depreciation base of €30,000

For more information, we've put together a guide to this topic to explore the different aspects in depth:

Read our article about :

Beev offers multi-brand 100% electric vehicles at the best prices, as well as recharging solutions.